Some of the insurance companies we work with

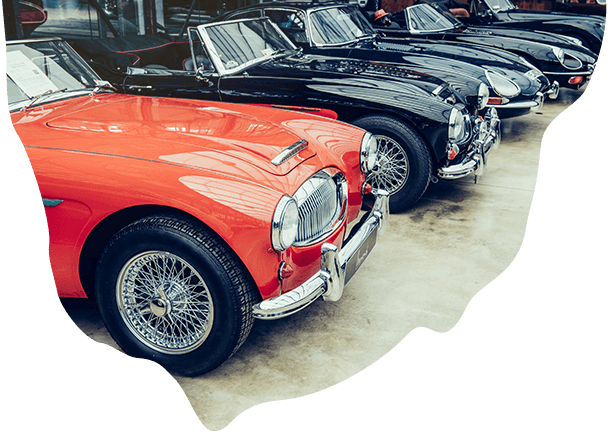

Classic and vintage cars are more than just a mode of transport – they’re a labour of love. At mustard.co.uk, we understand that and it’s why we work with leading UK insurers to help you compare classic car insurance you can depend on.

What does classic car insurance cover?

Classic car insurance covers the same risks and incidents as standard car cover but can also often include features tailored to older cars (for example, wedding hire cover).

There are three levels of cover available in the UK:

- Third party only – the UK’s minimum legal requirement of insurance you must hold for your vehicle. It only covers you for damage or injury to another person or their property if you cause an accident. However, you and your own vehicle will not be covered, and you will not be able to claim with your insurance. Damaged cause by theft or fire is also not covered by a Third party only policy.

- Third party, fire and theft– in addition to third party only cover, insurers will indemnify you if your car is stolen or damaged by fire.

- Comprehensive – provides everything included under third party, fire and theft and will also indemnify you if your car is damaged or destroyed in an accident.

Bear in mind that insurers set their own specific terms, conditions and exclusions. So, you may wish to familiarise yourself with exactly what is and isn’t covered to avoid unwanted surprises.

Call us on 0330 022 8791 for a quote over the phone

How much does classic car insurance cost?

Premiums for classic car insurance very much depend on your circumstances and insurers will take into account all sorts of factors, including:

- Your age – young drivers are likely to pay significantly more for car insurance as generally they’re statistically more likely to be involved in an accident.

- Where you keep your car overnight– the more secure your car, the lower you can expect your premium to be. If you can’t keep your classic car in a locked garage or private driveway, it could be worth thinking about investing in security features like an immobiliser or a steering wheel lock.

- The number of miles you drive– typically the more miles you do, the higher your premium is likely to be as there’s usually a greater chance of being involved in an accident and making a claim.

- Your claims history – fewer claims can lead to lower premiums.

- Your driving history– premiums are typically higher if you’ve got penalty points and driving convictions.

Can I buy classic car insurance if I’m restoring a car?

Yes, in most cases, you’ll be able to buy laid-up car insurance for your classic car. Policies are designed for cars that are not being driven and rather than providing cover for road accidents and third party damage, they cover risks including accidental damage, fire, and theft.

Compare classic car insurance

Searching for classic car insurance quotes online with mustard.co.uk means you can quickly and easily compare a range of policies from different insurers in one place.

What counts as a classic car for insurance?

There aren’t any set rules about what counts as a classic car for insurance purposes and there are a few definitions. For example, if you consider a classic car as one that’s exempt from road tax (or vehicle excise duty), then the car needs to be at least 40 years old.

The 40 years is applied on a rolling basis, so since 1 April 2022, a classic car is one that was built before 1 January 1982. From 2023 it will also include cars manufactured before 1 January 1983 and so on. Cars over 40 years old are also exempt from MOTs. It’s really important to know that you must apply for car tax exemption, you can’t simply stop paying for it when your car reaches 40.

For tax purposes (like benefits in kind) a classic car is one that’s at least 15 years old and has a market value greater than it’s list price.

When it comes to car cover, the definition of a classic car really depends on the insurer. Some will even consider relatively recently made cars to be classics if they’re no longer being manufactured.

Classic car insurance advice and FAQs

How to insure a modified car?

Insurers will usually ask whether your car has been modified (regardless of whether it’s a classic or not) so the process is exactly the same as for any other car. It’s worth knowing that modifications generally increase your premium, especially if those changes make your car more powerful or desirable.

If you’re tempted to keep quiet about your car’s modifications, don’t be. Not telling your insurer means you risk invalidating your policy and your insurer can refuse to pay out if you make a claim.

Are classic and vintage cars cheaper to insure for young drivers?

There’s no straightforward answer to this and it really depends on a combination of your own circumstances and the terms of your policy.

Generally speaking, car insurance for young drivers costs significantly more than the average. That’s because statistically speaking, young drivers are more likely to be involved in an accident – increasing the chances of a claim being made. Driving a classic car doesn’t necessarily reduce the risk of an accident and in some cases, insurers could consider that it increases the risk because there are fewer safety features in older cars.

On the other hand, classic car insurance quotes tend to specify a limited mileage – for example, you shouldn’t exceed 3,000 miles annually. Limiting the mileage and therefore spending less time on the road can help lower premiums.

Can joining a car club give me a discount on my classic car insurance quote?

Joining a classic car club can mean lower premiums as some insurers will offer members a discount. Before you sign up to an association, it may be worth checking whether it entitles you to a discount off your insurance and that the cost of membership doesn’t outweigh any reduction you do get.

Otherwise, factors that can influence the cost of your classic car insurance are very much the same as they are for standard car cover (for instance, your age, claims history and driving record.

What is an agreed value in classic car insurance?

This is when you and your insurer agree how much your car is worth. If your car is stolen or written off, your insurer will pay out the agreed value instead of the market value, which could be much lower.

Not all policies offer an agreed value but if you’ve spent time and money restoring your classic car, it could be a feature worth considering.

Agreed value is also known as ‘agreed valuation’ or ‘agreed value cover’.

Should I buy cheap classic car insurance?

No matter how much your classic car insurance costs, always be sure to check your policy documents and any conditions and exclusions set out.

Cheap classic car insurance could have limits on mileage, so you might need to add on additional features to bring it up to a level you’re happy with. In contrast, policies that look expensive may have less mileage restrictions and fewer exclusions overall, so might be more suitable for your individual needs.

Of course, that’s not to say cheap classic car insurance can’t be good value – it can be a good idea to do your homework first, so you don’t end up disappointed.

Can I buy short-term classic car insurance?

If you only use your classic car now and again, short-term car insurance could be worth considering. Policies last for as little as 24 hours up to a few weeks or months so they may be ideal if your classic car is only driven over the summer.

Short-term and temporary policies can be a good option if you’re taking your car to a classic car show for the day. Remember to let your insurer know if you’re exhibiting your car or driving it as part of a classic car rally so they can make sure your policy covers those events.

mustard.co.uk Car Insurance Reviews

Take a look at our genuine customer reviews